Memes have been a part of our internet culture for a long time. But they predate the worldwide web by more than a decade. They still exist, but a term called meme stocks is kind of going viral.

When the internet was made available in 1993, the meme transition went from real-life conversations to sharp images that anyone scrolling by, with little context, could understand.

Who remembers this:

Well, the famous cartoon Nyan Cat, with a severe case of rainbow runs, was sold in the Crypto Art world for $600 000.

We then saw a rapid development where memes formed subcultures that were even deployed or activated differently.

I mean, it transpired from us watching a floating Nyan cat to dancing for 30 seconds on Tik Tok, for Pete’s sake.

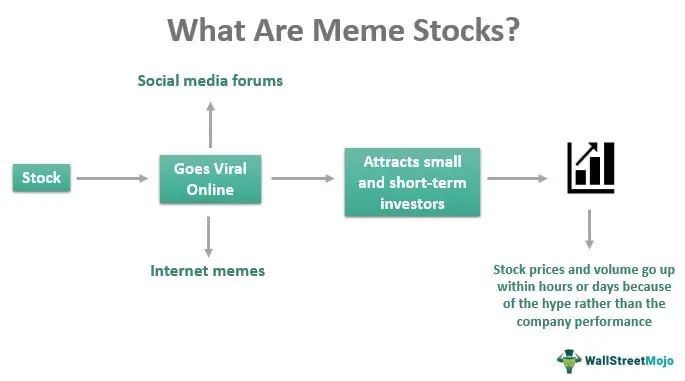

When we think of memes, we typically recall an image possibly including a witty phrase that went viral on social media. But what if a stock goes viral? Is that even possible?

There is a hot new stock that everyone is talking about on social media – a meme stock. Yes, you read right. This is a potential investment opportunity that has gone viral online.

The idea was so popular that the name of this type of stock was coined just two years ago due to the constant online digital appeal.

Meme stocks don’t mean that the internet’s favourite meme from that week is now trading on the stock market – which is what I initially thought.

Instead, companies’ stocks have gone viral online, causing investors to purchase them just for the meme.

Great, so…what are meme stocks?

This could be a flashy new company hailed online as the next big thing. Or it could be a stock that investors rally behind because they believe it is now undervalued.

However, this can change drastically on a whim, making meme stocks extraordinarily volatile and unpredictable.

Now just to give you an idea of why investors may be tempted, typically, a good stock would rise 30-50 per cent in a year, but a meme stock could make that move – overnight.

Meme stocks tempt investors with enormous returns in a concise amount of time if they buy them at just the right time.

So yes, it is hazardous. They are seen as more of a purely speculative trade rather than a long-term investment.

How does it work, and where did it come from?

What’s happening with companies like GameStop and TikTok, both prevalent social media applications, is extraordinary.

And it all started with a small company called WallStreetBets which currently has over 11 million followers.

A lot of jargon and tongue-in-cheek humour frames Wall Street as the enemy. They used memes to define who they were and use them to defy the action.

With retail investors posting their success on these online forums, it is tempting for readers to want to get in to make some quick cash. This led the momentum to push GameStop shares higher last year.

It went so high that last year the company’s market evaluation reached nearly $23 billion. Five times more than investing in something like a travel company in a month!

But be aware that if companies see a decline on the horizon, they can short the stock by using hedge funds. Hedge funds are financial partnerships that use pooled funds and employ different strategies to earn active returns for their investors.

It’s a risk but might be worth the pay. Once the community flags a meme stock, there is no stopping the momentum of the retail investors piling it into the store to push it higher. Despite what it may lack in fundamentals.

Other meme stocks or companies that once had their hay-day, meme stocks like AMC, GameStop and Blackberry share these nostalgic traits.

With social media further fanning the fires of interest, more and more people buy the stock with higher and higher prices. With a price that’s artificially high, it is inevitable the price will fall.

Investors are essentially playing a guessing game when it comes to meme stocks; if you’re right, you can benefit, but if you’re wrong, you’ll lose. Period.